Moving into your first apartment? Our first-time apartment renter’s guide below shares everything you need to know about how to rent your first apartment—including what to look for in a lease agreement, how to handle apartment hunting, analyzing your budget, and more!

Research Your Local Rental Market & Understand Legal or Lease Considerations

Navigating the apartment rental process can be challenging, but understanding the state of your desired area’s rental market—and local and federal expectations related to the lease and associated costs—is vital for long-term success and initial budgeting. Researching the rental market and your rights as a tenant will allow you to understand your range of choices as well as understand your obligations as a first-time renter.

Determine Which Area to Live In

After you’ve researched the local rental market, you’ll want to choose which area you want to live in. Keep average commute times to work or school, public transportation options, and proximity to nightlife spots or outdoor recreation in mind when picking a place. You can also consider factors like the availability of amenities like grocery stores and parks, as well as the overall feel of the neighborhood. Researching crime rates, school districts, and typical rental prices for different areas can help narrow down your options, ensuring you choose a location that aligns with your lifestyle and budget.

If you’re searching for an apartment in a city you’re unfamiliar with or moving to another state, use sources like Niche and AreaVibes to research local crime rates, median rental rates, and other livability factors. You can also ask locals for advice with online forums like Reddit. Especially if you cannot visit the new city you’re moving to, understanding its local economic market and social breakdown can help you move cross country and adjust to life in your new city.

Average Rent Prices, Availability, & Unit Sizes

Average apartment rent prices and unit sizes are influenced by geographic location, property type, market trends, and availability (the current number of rental units that are vacant and ready for new tenants to move into). Research what’s going on in your city’s local rental market with resources like Apartment List’s National Rent Report, Rent Cafe, or Rentometer to help you avoid overpaying—and use real estate apps to help with apartment hunting. Though the national average rent for an apartment is over $1,730 per month, rent prices vary significantly across the U.S.—with highly desirable coastal cities and major metropolitan areas in New England and the West Coast typically having higher rents compared to more affordable regions in the Midwest and the South. The size of apartment you’re able to get, as well as the amenities that come with your rental home, will ultimately depend on your budget and what’s common in your local real estate market.

Tenant Rights & Obligations

Apartment tenant rights, which vary by state and local laws, generally encompass the right to a habitable living environment, privacy from unwarranted landlord intrusion, protection against discrimination, proper handling and timely return of security deposits, and established procedures for maintenance requests, lease termination, and “just cause” eviction. Security deposit return timelines for apartments vary significantly by state, with most jurisdictions requiring landlords to return the deposit—often with an itemized list of deductions for damages beyond normal wear and tear—within a timeframe typically ranging from 14 to 60 days after the tenant vacates the property. While federal landlord-tenant laws are enforced by the U.S. Department of Housing and Urban Development, states will also have their own rules and regulations—be sure to learn more about tenant rights in your state before signing a lease. In addition to paying rent, apartment renters also generally have maintenance obligations that include keeping the unit clean and sanitary, properly disposing of trash, using appliances and systems as intended, and promptly reporting any damage or necessary repairs.

Budget & Evaluate Potential Costs Beforehand

Budgeting and evaluating the costs of renting an apartment can help you avoid financial strain and ensure your new home is affordable for your lifestyle. Understanding upfront fees, security deposits, and monthly expenses can help you prepare for renting your first apartment.

Planning a Rental Budget

To effectively plan an apartment rental budget, begin by calculating your gross monthly income (before taxes) and use the 30% rent rule, which states that you should expect to spend about 30% of your gross income on rent. Beyond calculating how much to pay for rent, factor in costs for potential utilities like electricity, gas, and water, as well as other monthly expenses like WiFi, trash services, and renter’s insurance. Make sure to also consider daily living expenses like groceries, gas, and entertainment to determine what your budget will allow for you to live comfortably. By accounting for all these fixed and variable expenses, you can create a realistic apartment rental budget that aligns with your financial goals.

Understanding Upfront Fees

Many landlords and property management companies require potential tenants to submit a fee along with their application—typically $25 to $75 per applicant—to offset the costs of the background and credit checks necessary for renting an apartment. Similar to an application fee, an administration fee is something landlords and rental management companies may charge alongside your application for processing all the paperwork—regardless if you move forward with a lease.

Once you’re approved, a security deposit is typically required to both secure your placement, as well as be a fund to repair damages you’ve caused to the unit upon move-out. First-time renters can expect this deposit—which is usually submitted when you sign your lease—to be equal to or less than one month’s rent. It’s possible to get part or all of your security deposit refunded when you move out, assuming you take good care of the unit while you live there. Another expense people renting their first apartment should be aware of is move-in fees. This fee is a one-time, non-refundable expense that’s typically between 33% to 50% of one month’s rent and is meant to cover the cost of getting an apartment ready for occupancy—including appliance repairs, painting, cleaning, and other preparatory maintenance.

Pet Deposits, Fees, & Rent

If you’re moving with a pet into your first apartment, you’ll likely face additional costs. For most rental properties, you’ll pay a security pet deposit, a one-time pet fee, and monthly pet rent.

- Pet deposits are usually refundable, cover all pets in the unit, and cost around $200 to $500. These are reserved by landlords for any damage the pet may cause to your unit beyond normal wear and tear when you move out.

- Pet fees are a single, non-refundable expense often between $200 and $500 meant to cover the cost of handling the typical wear and tear of pets in rental units. Sometimes a landlord will only charge a pet fee instead of a pet deposit.

- Pet rent will most likely be an extra $20 to $70 per pet per month. Pet fees can depend on how many pets you have, but many apartments will allow up to two pets.

Define Your Apartment Needs

For first-time apartment renters, clearly defining your needs and priorities is key to a successful apartment search. Consider creating an apartment wish list, deciding if you want a roommate, and thinking about the right property type for your needs.

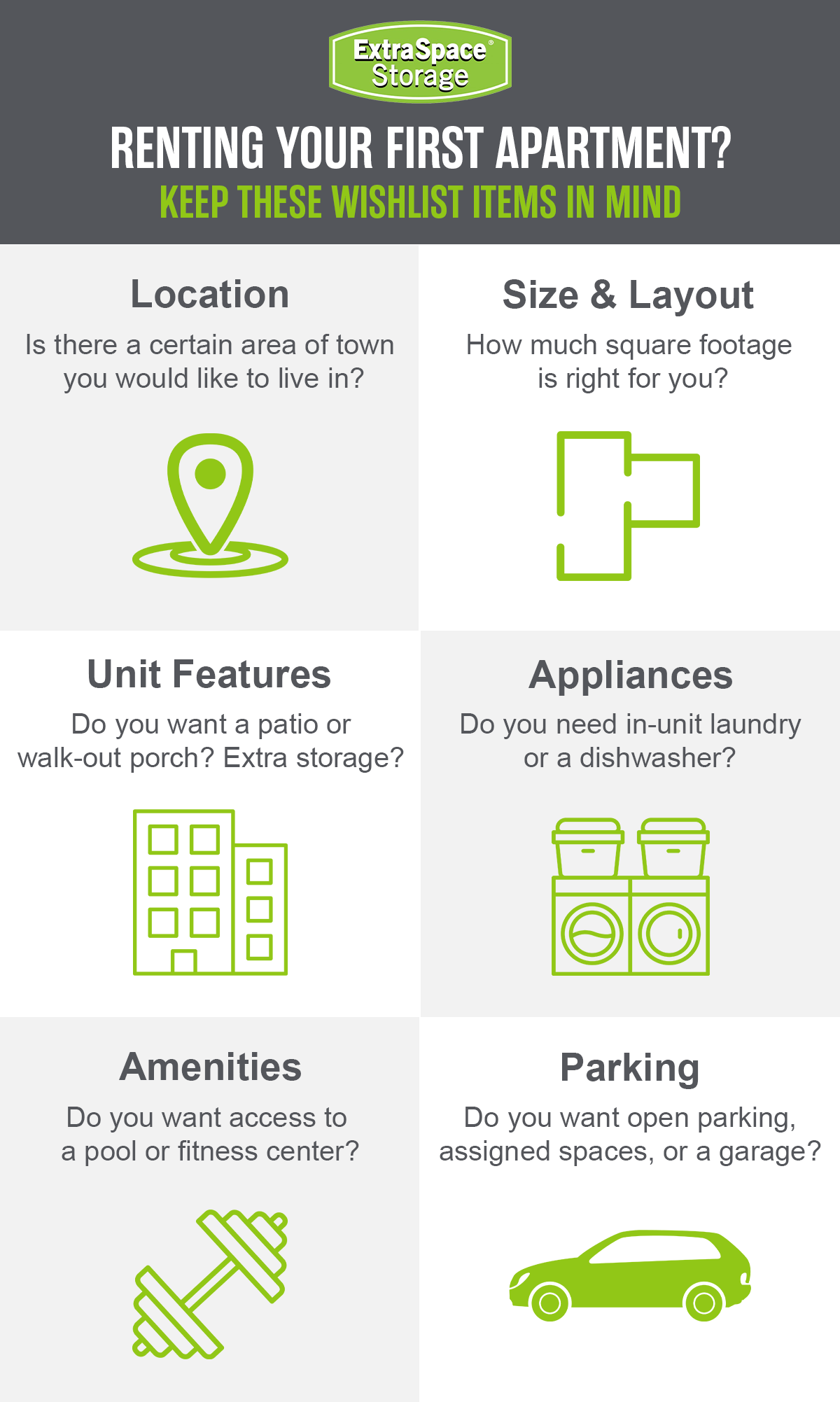

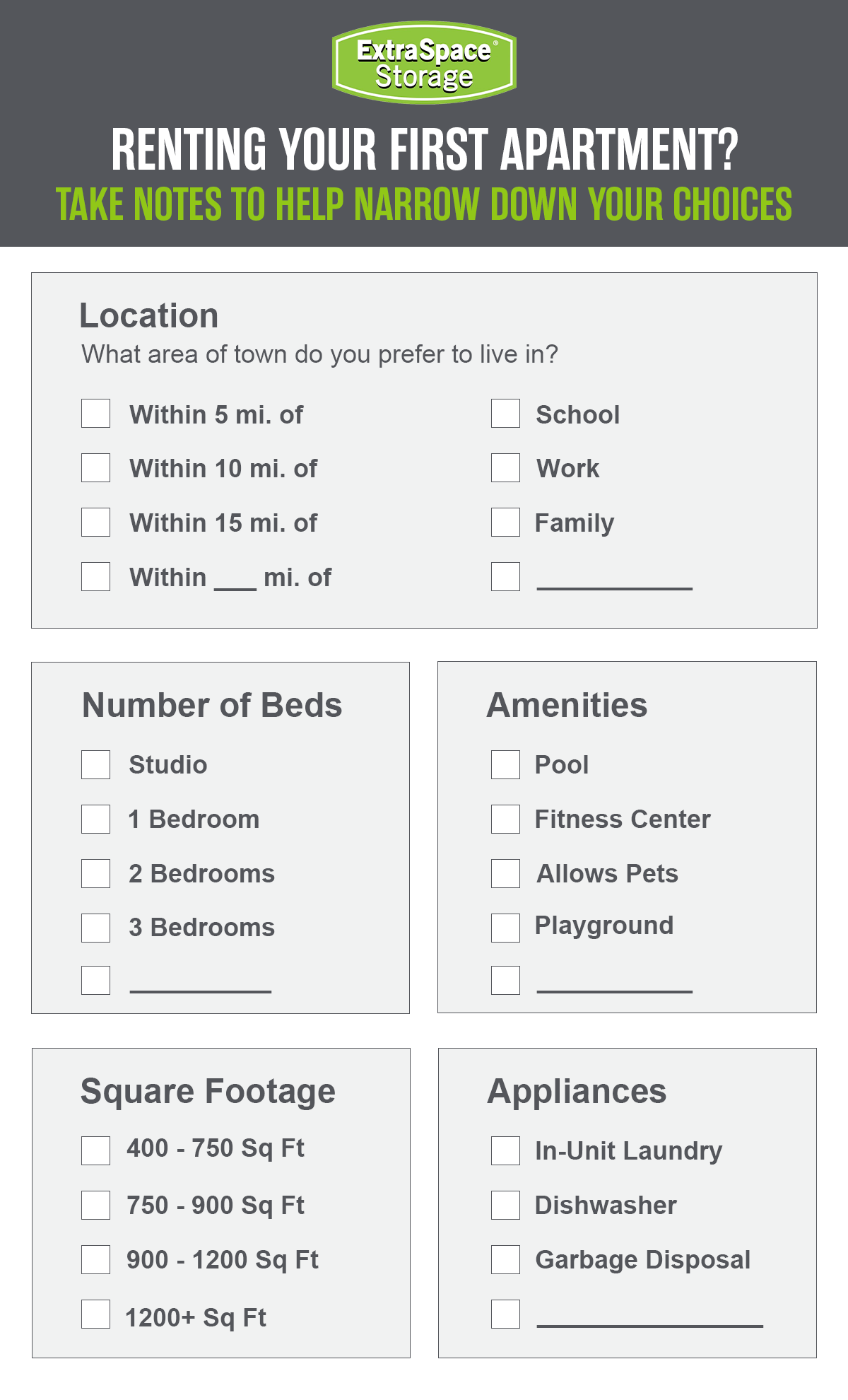

Create an Apartment Wish List

Creating a wish list will help you know what you’re looking for in a rental apartment ahead of time and give you direction when choosing between units. This apartment wish list should include “must-have” features that you can’t live without, as well as some features that would be nice to have but that you would be willing to compromising on. Consider your desired apartment location, size, and budget. Prioritizing your apartment wish list involves strategically balancing your desired lifestyle features—such as proximity to work or specific amenities—with the realities of your budget, ensuring your housing choices are both desirable and financially sustainable.

Features & Amenities

The features and amenities an apartment offers play a significant role in both its appeal and overall cost, directly impacting your daily life. In-unit apartment features commonly include essential appliances, washers and dryers, air conditioning, and storage closets. Common community amenities often include fitness centers, swimming pools, communal lounges or clubhouses, designated pet areas, package locker systems, and co-working spaces. These offerings, ranging from practical necessities to luxury conveniences, often influence a renter’s decision and overall satisfaction with their living space.

Consider Parking & Accessibility

You’ll also want to ask about guest parking availability and if there are any rules or restrictions at the complex for amount of guests or duration of time they can stay. Otherwise, there are different parking arrangements—often open or assigned parking and garage availability.

- Open parking operates on a first-come, first-served basis, and often comes without an additional fee, but can lead to difficulty finding a spot during peak hours.

- Assigned parking provides a designated, guaranteed spot, often for an extra monthly fee. This option offers convenience and peace of mind but occasionally leads to issues if another vehicle takes your assigned space.

- Garage parking is usually the most expensive parking option, but it provides your vehicle with the most protection and guarantees you a spot.

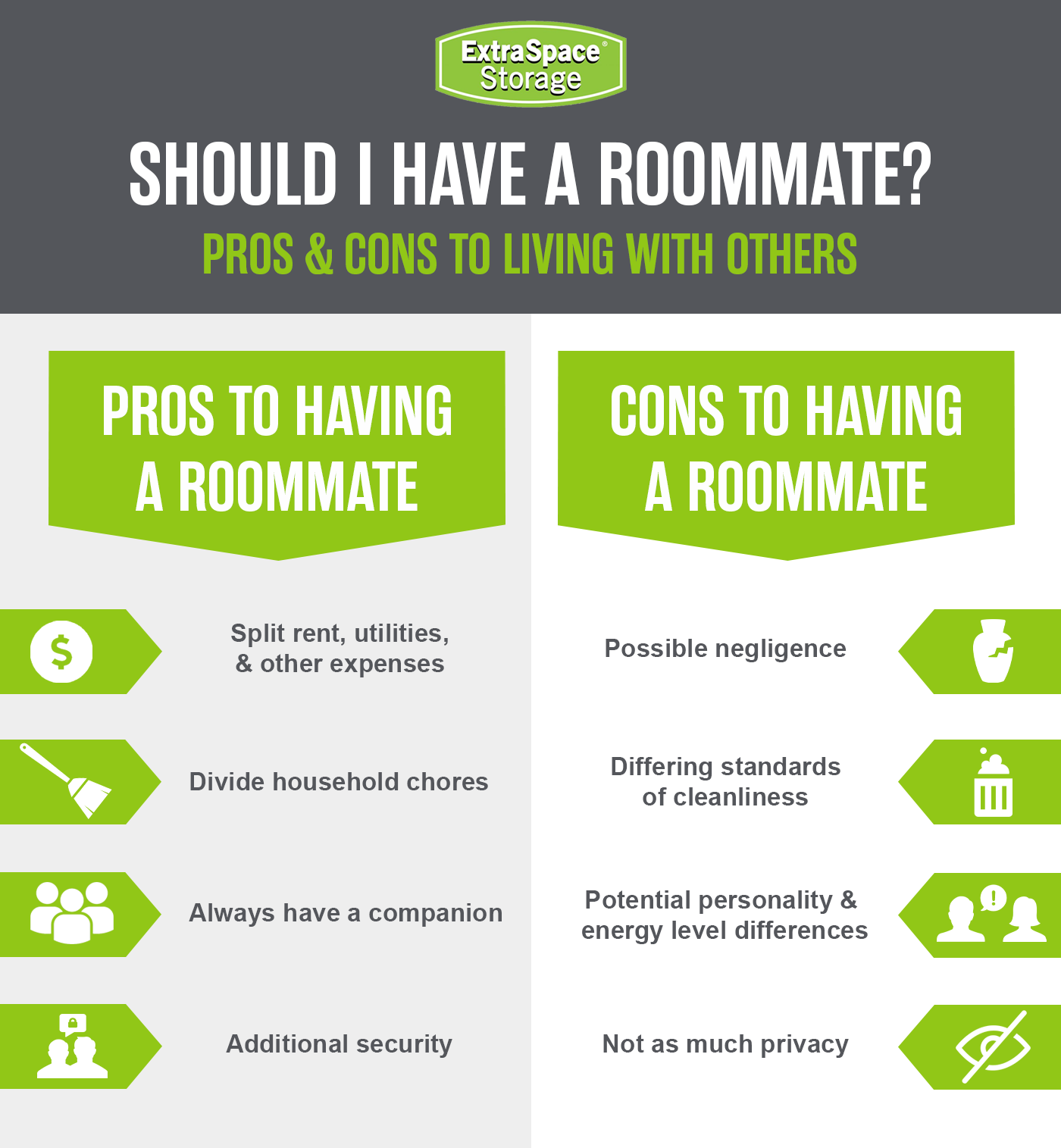

Decide If You Want a Roommate

Once you’ve decided to start looking for your first apartment, you’ll need to decide if you want a roommate. If you’re already used to living with someone, maybe you’d prefer to have the company. Perhaps you’re looking forward to having a space all your own. There’s no right choice, but your decision will make a big difference in your first apartment renting experience—especially when it comes to how much you pay each month. Sharing an apartment with a roommate carries significant financial benefits by splitting the cost of rent and utilities. It also has social implications, requiring open communication, shared responsibilities, and mutual respect to ensure a smooth living environment—especially if you’re living in a studio apartment with a roommate. Websites like RoomieMatch and Roommates make it easy to vet your options and get to know potential roommates.

How to Tour & Evaluate Potential Apartments

When touring an apartment for the first time, you’ll want to be prepared by asking questions about renting, spotting red flags, and testing appliances.

Prepare for an Apartment Tour

A great tip for first-time apartment renters is to bring to each tour a checklist of desired features and questions, a camera or phone to take photos or videos with permission, a notebook and pen for jotting down observations, and even a measuring tape to assess if your furniture will fit. It’s also important to understand the guest policy, particularly for extended stays, to ensure it aligns with your lifestyle and to avoid potential lease violations. Inquire about parking availability and associated costs, the community’s noise policy, security features, and the process for receiving mail and packages. Not everything can be assessed visually while you’re touring rental properties, which means you’ll need to ask the tour guide additional questions. A few good examples of what to ask during an apartment tour include:

- When is rent due and what are the leasing terms?

- What is the total monthly cost, including all fees and utilities not covered by rent?

- What is the pet policy?

- Do you require renter’s insurance?

- What is the parking policy?

- How are maintenance requests handled, what’s the typical response time, and is there 24/7 emergency maintenance?

- What is your guest policy?

- Have there been complaints from neighbors about noise?

- Has the property had any pest issues?

Spot Red Flags

On top of looking for positive features, you should also keep an eye out for red flags during every apartment tour. Spotting red flags on an apartment tour—such as visible signs of neglect, persistent strange odors, evasive answers from the landlord, or a reluctance to provide a written lease—is important for helping to identify potentially problematic living situations. Here are just a few red flags to watch for:

- Uneven floor

- Unreliable or suspicious landlord

- Bad odors

- Overly noisy

- Dirty unit

- Visibile pest traps

- Damaged cars in apartment parking lot

- Damaged locks, doors, & windows

- Excessively low rent

- Mold, mildew, & asbestos

Test Hardware & Appliances

When touring an apartment, take the time to test all hardware and appliances by turning faucets on and off, flushing toilets, checking water pressure, opening and closing windows, and ensuring all major appliances like stoves and refrigerators are in working order to identify any immediate issues. Check the locks on the doors and test the light switches to ensure they are working properly. Make sure there’s reliable cell service within the unit as poor signal can significantly impact daily life and work. If you do notice any issues, confirm with the landlord that they would be taken care of before a move-in date.

Prepare for the Apartment Rental or Lease Application

After touring apartments, you’ll begin applying for a lease to your top choices. Landlords or property management companies often use background checks, credit scores, and proof of income to assess a prospective tenant’s reliability and financial responsibility. In other words, they are doing their due diligence to ensure you’d be a reliable tenant and good neighbor. Here’s what you need to know to prepare for your first apartment application!

What to Look for in a Lease Agreement

As with other legally-binding contracts, it’s best to do a full review of the agreement—most landlords and management companies will allow you to take the lease home to review on your own time. This allows you to come back and ask informed questions before signing an apartment lease. Verify the lease term and ensure you understand the total monthly cost (i.e., the combined sum of the unit’s rent, any pet rents, community fees, sometimes utilities, etc.), due dates, and acceptable payment methods. Pay close attention to clauses regarding late fees, rent increases, and any grace periods. The lease should explicitly state the security deposit amount, the conditions under which it can be withheld, and the timeframe for its return after move-out, which are often governed by state law. Review the early termination clause, which outlines potential penalties—often a set fee or obligation to pay rent until a new tenant is found—and valid legal grounds for breaking the lease early without penalty.

Credit Scores & Application Approval

One of the main ways landlords screen tenants during the apartment application process is by checking their credit scores. A credit score is a three-digit number that summarizes an individual’s creditworthiness, indicating how likely they are to repay debts on time. Depending on your score, you’ll need to adjust your apartment hunting strategy. If you have a good credit score—usually 670 or higher—looking for your first apartment will be much easier. The credit inquiries landlords make when you apply for an apartment can potentially alter your score, and they should take this into account while you’re applying. Be aware that a landlord’s credit check can be either a soft inquiry, which doesn’t affect your credit score, or a hard inquiry, which can temporarily lower your score by a few points and remains on your report for up to two years, so it’s wise to ask the landlord which type they will perform before applying.

Renting with Limited or No Credit

If you have a fair or poor credit score or no credit history at all, there are a few simple ways you can increase your chances of having your apartment application accepted. You can put down more money upfront or provide documentation of your recent financial history—such as paychecks or bank statements—to show the landlord or rental company that you’ll able to make the payments. Another option is to have someone co-sign the lease. Adding a co-signer to an apartment lease means that another individual, typically with a stronger credit history or income, will assume legal responsibility for the rent and any damages if the primary tenant is unable to fulfill their lease obligations.

Avoiding Rental Application Scams

Unfortunately, rental scams are becoming increasingly prominent. First-time renters who lack experience with the process of renting an apartment may be especially susceptible to these scams. Being aware of what kinds of scams are out there and how to identify them can help keep you safe. There are a variety of rental scams out there, most of which revolve around using real listing photos on a fake, duplicate listing. Other scammers will create rental advertisements featuring images of an apartment or home they neither own nor have available for rent—sometimes the property will not even actually exist. In addition to more obvious scams, apartment lease manipulation refers to landlords or property managers using strategies like price-fixing algorithms to artificially inflate rents or coordinate pricing with competitors. When securing an apartment, prioritizing safe communication and payment methods is essential. All interactions should be documented in writing, and financial transactions should ideally occur through traceable methods like online tenant portals, bank transfers, or cashier’s checks rather than cash or unreliable peer-to-peer apps. You should also make every effort to see a unit in person before applying or signing a lease.

Post-Lease Essentials & Moving In

After the apartment lease is signed, you’ll want to think about the next phase of apartment renting, including packing and and move-in strategies, to ensure a smooth transition into your new home.

Create a Pre-Move-In Checklist

Setting up a pre-move-in checklist can help you ease into your new apartment. If utilities aren’t already set up and included in the price of the rent, contact service providers to schedule service for your move-in date about two weeks beforehand. Your landlord may have preferred providers, but you might also need to do your own research into the most affordable and reputable local options. Complete a change of address with the U.S. Postal Service (USPS) well in advance of your move-in date to ensure all your mail is forwarded to your new apartment. You’ll also want to set up renters insurance, which protects your personal belongings from theft or damage. You’ll also need to figure out who will help you on moving day, whether it be friends, family, or professional movers. If you need to reserve a moving truck, do so well in advance to ensure availability on your move-in date.

Pack Items & Furnishings

As soon as you’re able, start packing belongings you’re going to take with you to your new apartment. Organize moving boxes by which room they’ll go in, and make sure they’re clearly labeled to make unpacking easier. First-time renters may need to invest in a few first apartment furniture basics like living room seating, a kitchen table and chairs, a desk, and a bed, though you can do so after the initial move as well. Remember to consider the amount of space you have in your new apartment as you pick out these items. If you’re bringing items with you, take time to protect your furniture while moving. But, if your current furnishings won’t fit in your new home, consider donating or selling them online—alternatively, you can rent a self storage unit to store them in the meantime.

Document Your Apartment’s Move-In Condition

The day your lease kicks off, and before moving your belongings in, walk through the unit and take notes and photos of any damage you notice. Be as thorough as possible as you do this—this documentation can be used as proof when you move out that certain damage wasn’t your fault, which can increase the likelihood of getting your security deposit back. Formally request fixes from your landlord in writing to help prevent disputes over security deposit deductions later.

Clean the Unit Before Unpacking

Give yourself a clean slate in your new apartment by dusting, vacuuming, sweeping, and wiping down all the surfaces before moving your belongings in. Pay extra attention to sanitizing bathrooms and the kitchen to ensure they’re clean and ready for use. This will make it easier to maintain a tidy environment once you’re all unpacked in your new apartment.

Get to Know Your Neighbors

It might feel awkward, but introducing yourself to the people in neighboring units can make life in your first apartment feel more like home. Knowing who lives around you will not only provide a sense of security, but can also come in handy if you ever need to borrow an ingredient, tool, or other supplies—or handling noisy neighbors. For neighbor introductions, a simple, friendly approach is often best. Consider a brief verbal introduction when you encounter them in the hallway or common areas, giving out small notes with your name and apartment number, or participating in community events to meet others naturally.

***

Need storage space while moving to or living in an apartment? Extra Space Storage has self storage facilities that can help with your transition. Find self storage near you!